WHAT IS AN ONLINE NURSING DEGREE?

An online nursing degree is a program of study for current and aspiring nurses. You can find a nursing degree online at all levels from associate’s to doctorate. Each focuses on specific career goals and educational back ground. Some help with pursuing a mandatory state license.

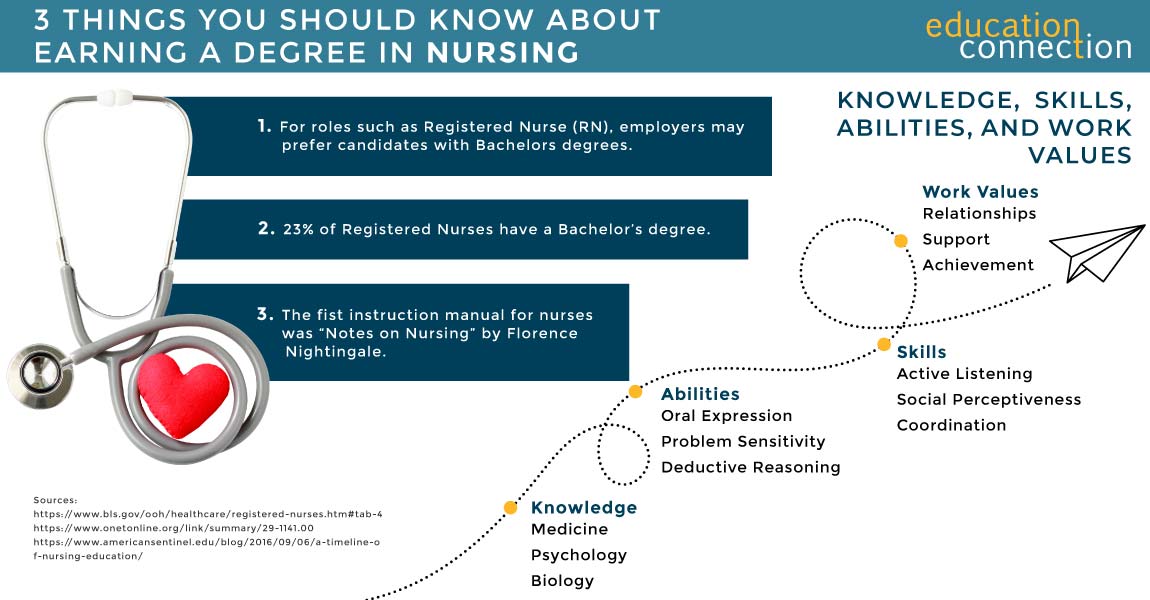

Registered nursing degrees often serve as a prep for the NCLEX RN exam. RNs need at least an associate’s degree in nursing (ADN). But another common path is the Bachelor of Science degree in Nursing (BSN).

Master of Science in Nursing (MSN) degrees often help RNs move into advanced practice. An MSN is needed for second nursing licenses and roles such as a nurse practitioner (NP) or a nursing instructor.

The highest level of nursing degree is the Doctor of Nursing Practice (DNP). This is a clinical leadership program. At the same level, is a PhD in Nursing which focuses on research and nursing science.

TYPES OF ONLINE NURSING DEGREE PROGRAMS

Bachelor of Science in Nursing (RN to BSN)

This program focuses on science and using it in nursing practice. Students take classes to gain skills in conducting health assessments. While covering lifespan health issues, other aspects focus on professional growth. These themes train RNs to work on health teams, manage cases and use IT.

Course Examples:

- Health Promotion and Education

- Foundations of Nursing Research

- Professional Leadership for Healthcare

Master of Science in Nursing (MSN)

The MSN program helps RNs prepare for advanced roles. While studying quality patient care methods, students may choose a nursing specialty.

Course Examples:

- Transforming Healthcare Through IT

- Clinical Prevention and Health Promotion

- Evidence Based Nursing Practice

Doctor of Nursing Practice (DNP)

The DNP program guides nurses to apply current research to patient care. Courses focus on improving health care systems. They also focus on enhancing patient outcomes. There are practice activities to help nurses gain expertise. In studying leadership and nursing science, a DNP project helps nurses tackle an area that interests them and encourages them to problem solve and foster change.

Course Examples:

- Scientific Foundations for Nursing

- Best Practices in Nursing Specialties

- Emerging Areas of Human Health

Commission on Collegiate Nursing Education (CCNE)CCNECCNE

RN TO BSN

A RN to BSN is a bridge program for registered nurse graduates of an ADN or diploma. These often provide transfer credit which means you won’t repeat material. Every school is different but programs usually last between one and two years. Since students entering this program already have hands on experience, many will find that these courses build on existing knowledge.

RN TO BSN TO MSN

An RN to BSN to MSN program is often for nurses with either a diploma or associate’s degree. The RN to BSN to MSN program is for those who would like to obtain their BSN while working toward their MSN. It may offer a step by step path to an MSN, though one must earn their BSN degree first. However, with this type of program, you can earn both your bachelor’s degree and master’s degree in less time. You can also do so at a lower cost than earning each degree separately. Many programs allow you to enroll at the bachelor’s level and take both bachelor’s and master’s level courses. You can then apply for admission to an MSN program.

SECOND DEGREE BSN

Second degree BSN programs are for students who earned a bachelor’s degree but not in nursing. While most nurses enter a four year BSN program, there are options for students who decide to become a nurse after they already complete their undergraduate degree. These programs usually credit general education courses. Then help students prepare for an RN license. Second degree BSN programs offer the quickest route for students to obtain an RN license when they have already earned a bachelor’s degree in another field.

MASTER OF SCIENCE IN NURSING (MSN)

An MSN degree is an entry point to advanced practice registered nursing (APRN) roles. For instance, a Critical Care Nurse. Or, Family Nurse Practitioner (MSN / FNP). They usually include a strong focus on clinical training. Evidence based practice is another key area of focus.

Some MSN programs have a non patient care focus. These include MSN Nurse Educator, Nurse Researcher and Nurse Executive programs. There are also joint degrees which pair nursing with another major. Business administration, public health or hospital administration are a few.

MSN educated nurses are some of the highest paid in the field. There are also certain positions that give preference to candidates who have their MSN degree.

DIRECT ENTRY MSN

Direct entry MSN programs are for non nurses who hold bachelor’s degrees in another field. These programs allow nurses without a BSN and non nurses to earn their master’s degree in less time. Part of the program is a prep for an RN license. Successful students then pursue their MSN courses in their chosen track.

DOCTOR OF NURSING PRACTICE (DNP)

A Doctor of Nursing Practice (DNP) is a terminal degree for practicing nurses. This is the highest degree that is awarded in a specific profession. A DNP is built to prepare experts in nursing practice. Such nurses have advanced knowledge to influence patient outcomes as well as direct patient care and health policy. DNPs who focus on advanced practice nursing are required to sit for the APRN exam.

At some point, the nursing profession wants to make it the entry point to advanced nursing. A DNP can help advance your career on the clinical/practice side, while a Doctor of Philosophy (PhD) in nursing focuses on teaching and research.

MSN TO DNP

An MSN to DNP program is for advanced practice nurses in pursuit of a Doctor of Nursing Practice. This program is for students who have completed their MSN degree in an area of advanced practice nursing and want to earn their DNP in the same focus. Such programs concentrate on systems leadership and clinical expertise.

PhD IN NURSING

A PhD in Nursing is a terminal degree for nurses who want to teach and research. It has the same academic value as a DNP but asks you to conduct research and excel in thought leadership. A PhD in Nursing builds on the foundation of nursing science. It brings together practice, policy, research and leadership. In addition to coursework, students are require to complete an exam with written and oral parts.

ONLINE NURSING DEGREE PROGRAMS

A typical Bachelor of Science in Nursing (BSN) will cover courses and lab time. But the actual curriculum depends on how you enter the program.

The goal of a BSN is to help nurses deliver quality direct or indirect patient care. There is usually a strong focus on developing professional skills. Central to this goal is helping students understand research and science (evidence). Then, learning to put this knowledge into practice (evidence based practice).

BSN degree students also learn the finer points of making health assessments. They often study emerging trends in health care therapies and professional ethics.

Other themes touch on health promotion and community health. These classes may cover diversity and health care management. This might mean learning how to coordinate patient care with other members of a health care team. Or, learning to manage case files.

If you still have general education credits to complete, factor these into your studies. The following are samples of potential BSN nursing major core topics:

- Nursing Theory and Role Development

- Healthcare Informatics

- Health Assessment and Health Promotion

- Bioethics

- Healthcare Policy and Advocacy

- Nursing Research

- Gerontology

- Population Health

- Nursing Leadership in Healthcare

Online BSN students often complete their clinical rotations within their local community.

1

Southern New Hampshire University

- Take advantage of some of the nation’s most affordable tuition rates, while earning a degree from a private, nonprofit, NEASC accredited university

- Qualified students with 2.5 GPA and up may receive up to $20K in grants & scholarships

- Multiple term start dates throughout the year. 24/7 online classroom access.

Popular Programs

Business Administration, Psychology, Information Technology, Human Services…

2

Colorado State University Global

- Ranked #8 by U.S.News & World Report for Best Online Bachelor’s Programs

- Apply up to 90 transfer credits for bachelor’s students, and 9 transfer credits for master’s degree students.

- CSU Global graduates experience a return on investment of 4:1, which means they receive $4 in salary and benefits for every $1 they invest in their education.

Available Programs

Business, Computer Science, Criminal Justice, IT, Psychology…

3

Western Governors University

- Award-winning programs created to help you succeed.

- A quality education doesn’t have to be expensive. Earn an accredited degree for less.

- Programs start monthly – Apply free this week!

Sponsored Schools

WHAT DO NURSING DEGREE COURSES LOOK LIKE?

Nurses can choose from a variety of different specialties. While the primary core curriculum of a bachelor’s or master’s degree in nursing emphasizes concepts such as communication, critical thinking, and compassionate patient care, the skills required of nurses in each particular specialty remain unique. Each concentration area has its own specialized coursework to match industry expectations. See below for some of the courses a student might take as part of a nursing degree online:

Some common courses include:

Health Assessment: Understand how to provide a plan of care for the needs of each person.

Introduction to Nursing Research: Gain advanced knowledge in how to use evidence based practice and research in your daily work.

Nursing Leadership and Management: Learn how to create an environment that influences the quality of patient care and satisfaction.

Family Centered Health Promotion: Explore how to promote service satisfaction by creating a familial bond during pediatric treatment.

Concepts in Community and Public Health: Learn how to assess and treat the emotional and physical health needs of individuals, families, and communities.

HOW LONG DOES IT TAKE TO EARN A NURSING DEGREE ONLINE?

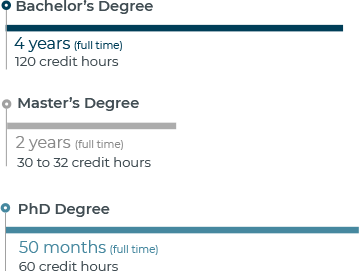

Without an RN license, a Bachelor of Science in nursing (BSN) may take four years at a college or university.

With a RN license, one may enroll in an RN to BSN program. This is for RNs who have an Associate’s degree or nursing diploma. As such, it may take about two to three years depending on your course load. Some colleges offer a nursing degree online that could be completed in as little as one year. RN to MSN is another option that depends on our your course load. Some programs tout as little as 20 months to finish.

If you already have a BSN and are looking to earn your MSN, most programs are about two years. And, a DNP is usually 2 to 3 years. There are also bridge programs available for those with a BSN looking to earn their DNP. Some online colleges offer programs that could be completed in as few as 30 months. However, part time degree seekers will likely finish in 3 years. Even if they are earning their nursing degree online.

BSN PROGRAM EXAMPLES

| School | # of Credits | Start Dates | Minimum Months |

|---|---|---|---|

| Purdue Global | 90-130 | 4 | 18 |

| Grand Canyon University | 120 | Multiple | 12 |

| Colorado Christian University | 120 | 3 | 12 |

THE AVERAGE COST OF AN ONLINE NURSING DEGREE PROGRAM

The cost of a nursing program varies from one school to the next. In some colleges, there is an in state and out of state tuition too. According to the most recent data, the average in state cost of a registered nursing degree is $6,095. The average out of state cost is $28,360.

Many online schools charge by the credit. Compare cost per credit for these schools that offer BSN programs in nursing.

| School | Degree Level | # of Credits | Cost per Credit | Total Tuition Cost |

|---|---|---|---|---|

| Purdue Global | BSN | 130 | $315 | $40,950 |

| Grand Canyon University | BSN | 120 | $470 | $56,400 |

| Regent University | BSN | 120 | $295 | $35,400 |

TOP SCHOOLS THAT OFFER NURSING DEGREES

According to the most recent data, there were over 50 schools that offer registered nursing degrees or programs. From those schools there were 266,651 registered nursing degrees or programs awarded to students. The majority (57%) of these programs were bachelor’s degrees.

| School | 2021 Degrees awarded | 2023/24 Tuition (out of state unless *) |

|---|---|---|

| Chamberlain University-Illinois | 9,596 | $20,604* |

| Western Governors University | 10,730 | $8,300* |

| Grand Canyon University | 5,204 | $17,450* |

| Walden University | 5,004 | $12,498* |

| The University of Texas at Arlington | 3,456 | $29,660 |

| Ohio University Main Campus | 2,103 | $24,114 |

| National University | 404 | $13,320* |

| Ivy Tech Community College | 1,366 | $9,465 |

CHOOSING AN ACCREDITED NURSING PROGRAM

Online nursing programs are available in schools with regional or national accreditation. This type of approval may allow a student to take part in federal aid and state entitlement programs.

Or, use transfer credits from another accredited nursing school. This is important as it may save you time and tuition.

An accredited school may also volunteer to have their BSN, MSN and DNP programs assessed. In doing so, they commit to follow and maintain quality standards. Especially about core curriculum.

Accredited BSN programs are one example. They tend to follow the Essentials of Baccalaureate Education for Professional Nursing Practice (AACN, 2008). This step may help you prepare for nationwide exams for the licensing of nurses. This is crucial in a regulated field like nursing.

The main accreditors of nursing programs in the U.S. are:

- The Accreditation Commission for Education in Nursing (ACEN): accredits all types of nursing education programs including master’s, baccalaureate, associate’s and diploma

- The Commission on Collegiate Nursing Education (CCNE): accredits bachelor’s, graduate and residency programs in nursing

- The Council on Accreditation of Nurse Anesthesia Educational Programs (COA – CRNA): accredits nurse anesthesia programs at the certificate, master’s and doctoral degree levels

- The American College of Nurse-Midwives Division of Accreditation (ACNM): accredits nurse midwifery programs

The length of the accreditation process varies by program. But most accrediting agencies maintain a database with current statuses.

NURSING CAREER PATHS AND POTENTIAL SALARIES

Nursing careers can help you change and save lives. Many people think the only thing they can do with a nursing degree is become a nurse, but there are various options for students who complete a Nursing program. Salary as a Nursing professional is largely decided by your specific job title, your level of education, your experience and your skill. Consider the following careers, with statistics collected by the U.S. Bureau of Labor Statistics in 2022.